Australian company DroneShield Ltd. (DRO:ASX; DRSHF:OTC) has become a big story since we last looked at it early in February. This is a stock we started accumulating in the AU$0.10's and AU$0.20's back in 2022. At the time of the February update, it was priced at AU$0.585, and immediately after, it zoomed up to touch AU$0.92 before reversing and correcting back hard to about AU$0.59.

After this correction, it trended steadily higher again to approach its late February highs before suddenly blasting through them to new highs about a week ago when the defense software company said the NATO Support and Procurement Agency had approved the first counter-small UAS (CUAS) procurement framework agreement in NATO history. Within a day of this news, the company announced an AU$75 million funding exercise that swiftly increased to AU$100 million due to robust demand. it is understood that it started out as an AU$50 million raise and was upscaled from there due to strong investor demand.

The issue price of all these new shares is 80 cents, which is significantly below the last traded price at AU$1.12 before the stock was halted a few days back, yet rather oddly, the stock was not halted on the US OTC market until Friday morning, by which time it had dropped back quite hard. This suggests that once trading resumes in Sydney, which is supposed to be sometime today, the price will drop back quite hard, too.

The point is that, however much it does drop back as a result of the funding, it will be viewed as an opportunity to buy it or add to positions because the outlook for the company is so positive. After all, the company has an AU$500 million sales pipeline with a target of AU$300 million to AU$500 million in annual revenue, and it has some 90 qualified projects with government customers — including the Australian Department of Defence and the U.S. State Department.

The main purpose of this update is to alert you to the probability of the funding knocking the price back down temporarily on the Australian market, which would be viewed as presenting an opportunity to buy or add to positions, although it is thought that it probably won't drop back all that much as the outlook for the company is so positive.

Now, we will proceed to take a brief look at the latest charts.

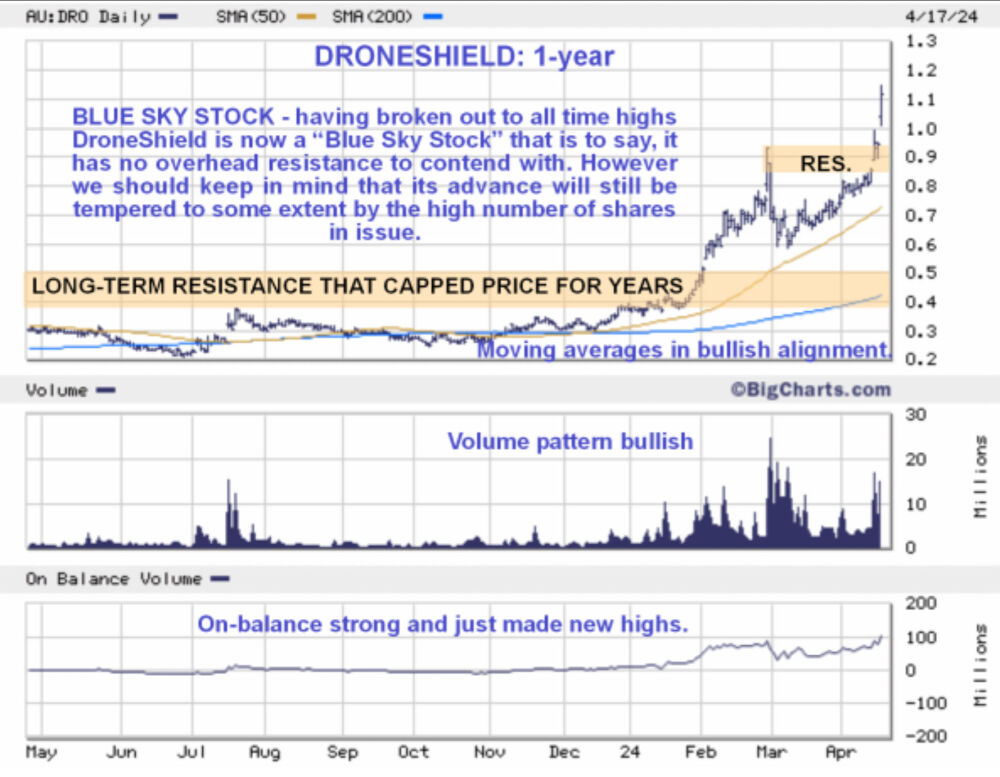

On the 1-year chart, we can see the strong gains in the stock from late January. This is when it really started to get moving and broke out to new all-time highs as the company's order book started to bulge in tune with growing global conflict in the direction of a World War, which has now begun. This strong advance culminated in it spiking above AU$0.90 late in February, as mentioned above, after which it reacted back hard to under AU$0.60, where it found support above its rising 50-day moving average.

Then, it gained traction once more and advanced in a steady uptrend before breaking dramatically to new highs on the NATO news. So DroneShield is now a "blue sky" stock even if it does get knocked back temporarily as a result of the large funding currently underway, and it has no overhanging supply to create resistance.

The long-term chart going back to 2016 shows that it is just this year that DroneShield has finally broken out of the long trading range that it had been stuck in for years; thanks to the latest developments, we can now classify it as a giant base pattern.

Again, we can see that with no overhanging supply, the sky's the limit, although obviously, its progress will be tempered by the high number of shares now in issue. that said, the company looks set to make huge profits for years to come and thus should prove to be a solid investment.

DroneShield's website.

DroneShield Ltd. (DRO:ASX; DRSHF:OTC) closed at AU$1.12 on April 17, 2024, and $0.585 on April 19, 2024.

JUST IN: The stock has resumed trading in Sydney while this was being written, and, as surmised from the behavior of the late halted OTC stock above, it has opened quite heavily down and is currently trading at AU$0.915, down 18.3%. From the price of the funding at 80 cents and the stock's behavior this morning in Sydney, it looks likely that it will trade in a fairly narrow range between the current price and 80 cents, although we should note that demand for the stock is so strong that the funding may be completed very soon, and once it is, the stock should resume the upward path again. So, this will be a good time for those interested in the stock to buy or add to positions.

IMPORTANT FOOTNOTE ADDED ON THE 24TH: DroneShield dropped another 10.2% last night on the Sydney SE to close at AU$0.835 and is now very close to the funding price at AU$0.80. It is therefore considered to be time for those interested to wade in and buy the stock, bearing in mind that as soon as this funding is closed, which could happen very soon given the demand and interest in the stock, despite the magnitude of the issue, it is likely to take off strongly higher gain. The risk is considered to be down to AU$0.80, and we're almost there now.

Want to be the first to know about interesting Technology and Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of DroneShield Ltd.

- Clive Maund: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.